10 Essential Payment Gateway Test Cases: A Comprehensive Guide to Payment Gateway Testing

In today’s digital economy, secure and efficient payment processing is crucial for any business operating online. Payment gateway testing plays a pivotal role in ensuring that transactions are handled smoothly, securely, and without errors. This comprehensive guide delves into 10 essential payment gateway test cases that every e-commerce platform, financial service provider, or online business should implement.

By thoroughly examining these critical payment gateway scenarios, you’ll be better equipped to identify potential issues, enhance security measures, and optimize the overall performance of your payment gateway system.

Whether you’re a developer, QA specialist, or business owner, understanding these test cases is key to maintaining customer trust and maximizing conversion rates.

Don’t miss: Related Test Cases

What is a Payment Gateway?

A payment gateway is a technology that merchants use to accept credit cards, debit cards, net banking, and other payment methods from customers. It acts as an intermediary between the merchant and the financial institutions to process and authorize payments securely.

With the rise in digital payments on e-commerce platforms, merchants need to provide customers with secure and user-friendly payment gateways.

Payment gateways services encrypt sensitive information like card numbers, CVV, passwords, pins, etc. These gateways also stand high loads without any failure in performance.

Ensuring the robustness of a payment gateway is crucial to maintaining customer trust and supporting seamless transactions. Therefore, thorough testing is essential to validate functionality, performance, and security, thereby guaranteeing smooth and error-free financial interactions.

Some of the common examples of payment gateways are Paypal, Stripe, Square, Paytm, Razor pay, Instamojo etc.

Types of Payment Gateways

To better understand the testing process, let’s delve into the different types of payment gateways:

#1. Hosted Payment Gateway

A hosted payment gateway like PayPal redirects customers to the payment service provider’s page to complete the transaction. This type of gateway is simple to set up and often requires minimal compliance with Payment Card Industry Data Security Standard (PCI DSS). Testing a hosted payment gateway involves ensuring the redirection process works flawlessly, transaction processes securely, and that post-payment redirections bring the customer back to the merchant’s site without any issues.

#2. Self-hosted Payment Gateway

Self-hosted payment gateways like Shopify or Stripe involve hosting the payment processing form on the merchant’s server. Customers enter their payment details directly on the merchant’s website, and the information is then sent to the gateway’s URL for transaction processing. This method offers greater control and customization but requires strict adherence to PCI DSS. Testing a self-hosted payment gateway necessitates validating the secure transmission of data, merchant site compatibility, and accurate processing of payment details.

#3. API-hosted Payment Gateway

An API-hosted payment gateway allows for greater integration and flexibility by offering API endpoints to process transactions directly. This enables merchants to provide a seamless user experience without redirecting customers to external sites. Testing an API-hosted payment gateway involves checking the implementation of API calls, handling responses, and verifying the security of the transaction process. Additionally, ensuring smooth integration with the merchant’s systems and handling various error scenarios are crucial.

#4. Local Bank Integration Gateway

Local bank integration gateways involve direct integration with local banks to process payments, often used in regions with specific banking regulations or preferences. These gateways facilitate transactions by communicating with the local banks’ systems directly. Testing a local bank integration gateway requires ensuring all transactions comply with local banking standards, validating the secure transmission of data, and monitoring the accurate processing of payments. Moreover, testing should cover different payment methods supported by the local banks.

By understanding these various payment gateway types, we can structure the required test cases to ensure comprehensive validation of each system, paving the way for secure and efficient financial transactions.

What is Payment Gateway Testing?

Payment gateway testing involves assessing the payment gateway to ensure it functions correctly, securely, and efficiently. This testing checks various scenarios to validate that the payment process works flawlessly, from transaction authorization to settlement.

Why Payment Gateway Testing is Important?

Payment gateway testing is important for several reasons.

- Ensures the accuracy of financial transactions, preventing issues such as incorrect charges or payment failures, which can negatively impact customer trust and satisfaction.

- Makes sure that the customer makes successful payments to the corresponding website.

- Inspects, checks and reduces the technical issues that the customer might face during payment.

- Verifies the security measures in place, safeguarding sensitive customer data from potential breaches and complying with regulatory standards like PCI-DSS.

- Avoids data glitches and protect our customers’ financial details from hackers.

- Protects the reputation and integrity of the company by identifying and fixing security incidents.

- Ensures that payment gateway system integrations work seamlessly, providing a smooth and unified user experience.

- Improves the overall performance of the system, accuracy and security of the payment process.

What is the basic terminology used in Payment Gateway testing?

Merchant- A Merchant is a person or a company who sells a product or service, they can be the service provider, product seller, the eCommerce store, etc. They accept online payment for their business.

Acquiring bank- It is the Merchant’s bank, when the customer pays through the payment gateway, the amount gets credited to the acquiring bank.

Issuing bank- It is the Customer’s Bank when the merchant receives the payment, the amount gets deducted from the issuing bank.

Transaction- It is the payment made in the checkout of the payment gateway. It generates a unique ID, it’s called transaction ID.

Authorization- Payment gateway sends authorization requests to the customer’s account(issuing bank) to deduct the amount. An authorization request may get denied or approved by the issuing bank.

Authentication- It is the method by which the bank validates the identity of the customer making the payment, it can be CVV, OTP, PIN, Password etc.

Don’t miss: Software Testing (A-Z) Terms & 100+ Software Testing Types

What are the prerequisites required for payment gateway testing?

- Collect test data for dummy debit/credit card information.

- Gather information related to the payment gateway type we are going to test.

- Finalize the parameters for Performance testing for Payment gateway flow.

- Gather information about error codes that might occur in the Payment gateway, that way we will know whether the error is from our end or it’s related to the payment gateway.

- Setup a Sandbox environment to validate payment processors without actually paying the amount.

How to Test Payment Gateway Functionality?

Payment gateway testing can be performed in both manual and automated way.

Manual Testing

- Setup: Register with a payment gateway and set up the necessary credentials for sandbox/testing environments.

- Test Case Execution: Manually execute test cases such as valid/invalid transactions and check the system’s behavior.

- Logging Results: Record outcomes, errors, and any unexpected behaviours for further analysis.

Automated Testing

- Select Tools: Choose tools like Selenium for web-based interactions and Postman for API testing.

- Write Scripts: Develop automated scripts to simulate different payment scenarios.

- Continuous Integration: Integrate these scripts into the CI/CD pipeline to ensure consistent validation with each update.

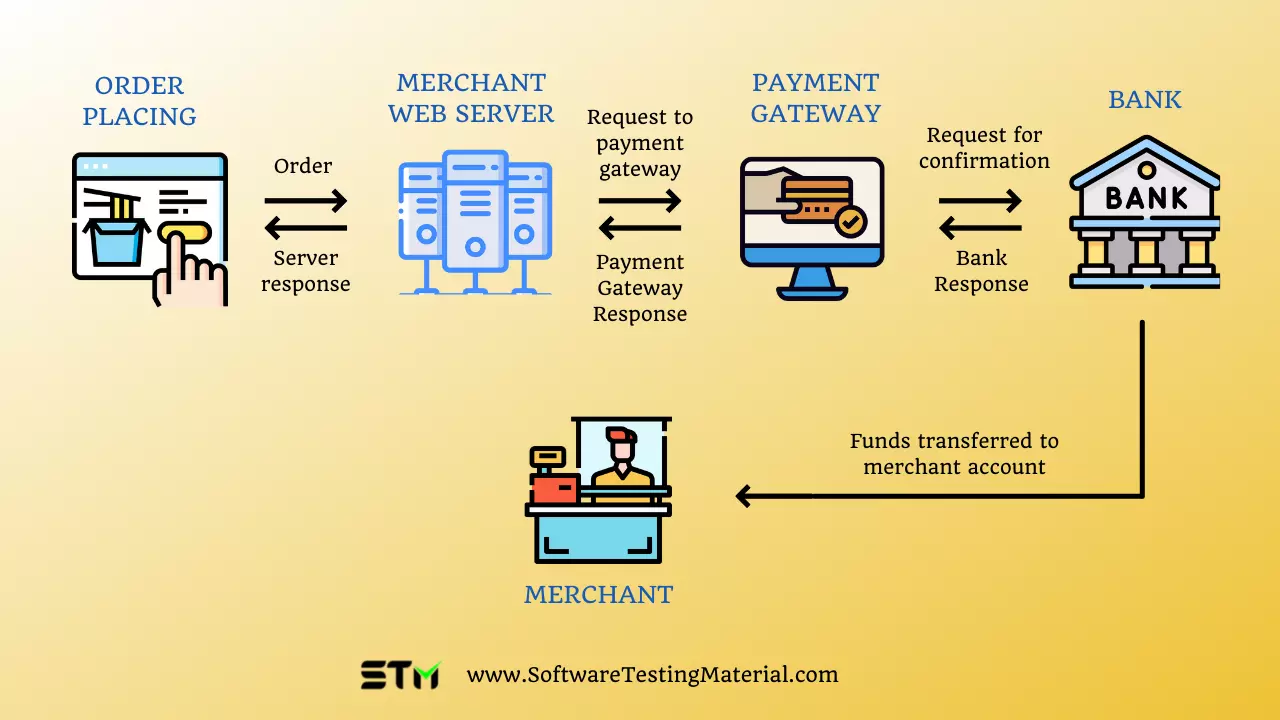

Before getting into how to test the functionality of the Payment gateway, let’s look at how the Payment gateway transaction flow functions.

Step #1: Customer chooses a product or a service and gets the payment page.

Step #2: They enter their card details like number, CVV, expiry date etc. This information is securely passed to the payment gateway.

Step #3: The payment gateway encrypts the card details and performs fraud checks before it sends the data to the acquiring bank.

Step #4: The acquiring bank sends the information securely to the card schemes, it performs another fraud check and sends it to the Issuing bank.

Step #5: Issuing bank conducts another fraud screening and authorises the transaction. Approval/decline message gets sent to the Acquirer through card schemes.

Step #6: Payment gateway receives this accept/decline message which transmits the message to the merchant. If the payment gets approved, the Acquirer collects the payment from the Issuing bank and deposits funds to the merchant account.

Now that we know how a payment gateway functions let’s look at how it can be tested.

What types of testing is required on the payment gateway?

#1. Functional Testing

In Payment gateway, we perform functional testing for new or less established systems. It is vital as it ensures that the system is fully functional and its features are working as expected. It helps in verifying both the application and the gateway.

Further reading: Functional Testing Tutorial

#2. Security testing

Security testing ensures that the Payment gateway protects the data that it processes during payment. It secures the system from cyber attacks, hackers and other security vulnerabilities. We should make sure that we take care of sensitive information provided by the customer.

Further reading: Security Testing Tutorial

#3. Performance testing

In Payment gateway, performance testing makes sure that the application won’t fail if a great number of users submit payment simultaneously. This type of testing is crucial especially during huge sales or holiday seasons. It ensures that the system functions normally even when there’s a huge load.

Further reading: Performance Testing Tutorial

#4. Integration testing

Usually, an e-commerce platform or any other application that requires payment needs a payment gateway integrated into the system. Integration testing ensures that the payment gateway is seamlessly integrated with the merchant’s website. Here we test the order placement, payment processing, order confirmation, i.e the complete transaction flow functions as required.

Further reading: Integration Testing Tutorial

10 Essential Payment Gateway Test Cases

Here are 10 essential payment gateway test cases:

- Valid Transaction Processing

- Invalid Card Number Handling

- Expired Card Detection

- CVV Validation

- 3D Secure Authentication

- Payment Decline Scenarios

- Refund Processing

- Transaction Timeout Handling

- Currency Conversion Accuracy

- High-Volume Transaction Load Testing

Each of these test cases is crucial for ensuring the reliability, security, and efficiency of a payment gateway. They cover a range of scenarios from basic functionality to edge cases and performance under stress.

#1. Valid Transaction Processing: This test case verifies that the payment gateway correctly processes a valid transaction. It involves using a valid card number, expiration date, and CVV to make a purchase. The system should successfully authorize the transaction, deduct the correct amount from the card, and confirm the payment to the merchant.

#2. Invalid Card Number Handling: This test checks how the system responds to invalid card numbers. It involves attempting transactions with incorrectly formatted card numbers, numbers that don’t pass the Luhn algorithm check, or numbers known to be invalid. The system should reject these transactions and provide clear error messages.

#3. Expired Card Detection: This case tests the gateway’s ability to identify and reject transactions using expired cards. It involves attempting purchases with cards whose expiration dates have passed. The system should decline these transactions and notify the user about the card’s expiration.

#4. CVV Validation: This test ensures that the Card Verification Value (CVV) is properly validated. It includes attempts with correct and incorrect CVV numbers. The system should approve transactions with correct CVVs and reject those with incorrect ones, enhancing security against fraud.

#5. 3D Secure Authentication: This case tests the implementation of 3D Secure protocols (like Verified by Visa or Mastercard SecureCode). It verifies that the system correctly redirects to the card issuer’s authentication page and handles both successful and failed authentications appropriately.

#6. Payment Decline Scenarios: This involves testing various decline scenarios, such as insufficient funds, card reported lost or stolen, or exceeding daily transaction limits. The system should handle these declines gracefully, providing clear reasons for the failure to the user.

#7. Refund Processing: This test case verifies the gateway’s ability to process refunds correctly. It includes full and partial refunds, ensuring that the refunded amount is accurately credited back to the customer’s account and that the merchant’s account is debited accordingly.

#8. Transaction Timeout Handling: This case tests how the system handles scenarios where a transaction takes too long to process. It ensures that the system has proper timeout mechanisms in place, doesn’t double-charge the customer, and provides clear feedback about the transaction status.

#9. Currency Conversion Accuracy: For gateways that handle multiple currencies, this test verifies the accuracy of currency conversions. It involves processing transactions in different currencies and checking that the converted amounts are correct based on current exchange rates.

#10. High-Volume Transaction Load Testing: This test case assesses the gateway’s performance under high load. It involves simulating a large number of concurrent transactions to ensure the system remains stable, maintains accuracy, and doesn’t experience significant slowdowns during peak times.

Sample Other Payment Gateway Test Cases

Let’s see some other sample Test cases for Payment Gateway testing

Functionality based Payment Gateway Test Cases

- Check if you can, each payment option is selectable and text boxes are typeable as well.

- Verify whether the saved credit/debit card is available on the payment page.

- Check whether you can set a card as default.

- Check whether the customer receives the corresponding notification email and text after a successful/unsuccessful payment.

- Verify whether the payment gateway redirects back to the application after the completion of payment.

- Check if the amount, taxes, discount, store credits etc get calculated correctly.

- Check whether the system changes the currency and language format based on the user’s request.

- Check whether the payment doesn’t proceed when any mandatory field is empty.

- Check the system’s behaviour when the internet gets disconnected during payment.

- Check if any double payment happens

- Verify different combinations of valid and invalid data for Card number+Expiry date + CVV.

- Check whether each payment option gets directed to the respective payment flow.

Performance-based Payment Gateway Test Cases

- Check the performance of the payment gateway when several users are trying to complete a transaction at the same time.

- Check whether the processor responds quickly

- Check whether the time taken for the application to reach the payment gateway is as per the requirement.

- Verify whether the same amount gets credited to the customer during the refund, also check the time frame of the refund is as per the terms and conditions.

- Check whether the transaction details get updated in the database in the right format.

UI based Payment Gateway Test Cases

- Verify whether the labels and boxes are visible

- Check if the card number gets masked while entering.

- Check whether the Payment gateway company logo/name is visible.

- Verify if all the payment options are visible.

- Verify whether the colour scheme matches the specifications.

- Check whether proper messaging appears when the payment is successful/failed.

- Check whether the promo code, gift card, coupon section is visible.

- Verify whether all the errors or mistakes entered by the customer gets highlighted in red.

Security-based Test Cases for Payment Gateway

- Check whether the card details get masked.

- Check whether the sensitive information gets encrypted.

- Check whether the application is safe from cross-site scripting, spoofing etc.

- Verify whether that online transaction happens on a secure channel like HTTPS.

- Verify all the fraud prevention/ security settings of the application.

- Verify whether the customer receives the OTP when initiating the transaction from their bank details.

- Also verify the same scenario with multiple cards linked to different phone numbers in the same account.

Payment Gateway checklist

- Check whether you have all the test data required for the payment gateway, various duplicate card details, Bank ids, gift cards etc.

- Gather test data for payment wallets.

- Check whether you have the documentation related to error codes.

- Verify all the functionality and settings based on payment thoroughly.

- Ensure all the pop-up messages are working fine.

- Verify fraud preventive measures are working fine.

- Check session expiry scenarios.

- Check the integration between the application and payment gateway.

- Check the behaviour of the payment gateway when interrupted.

Frequently Asked Questions

How to perform API testing of the payment gateway?

To perform API testing of the payment gateway, you need to send different requests to the API and check the responses. Make sure the API processes transactions correctly and securely. Verify that it handles errors properly and responds within an acceptable time frame. Use tools like Postman or SoapUI to help with this testing.

What is a payment gateway example?

A payment gateway is a service that helps online stores process payments. For example, PayPal and Stripe are payment gateways that allow customers to pay using their credit cards or digital wallets. They make sure the payment is secure and goes through smoothly.

What are the risks of neglecting proper Payment Gateway Testing?

Not performing proper payment gateway testing can lead to several risks. There might be errors during transactions, causing customers’ payments to fail. This can result in lost sales and unhappy customers. Security vulnerabilities may also go unnoticed, which could lead to data breaches and financial fraud. Additionally, the platform could face downtime or slow transaction processing, harming the business’s reputation.

What are the challenges of payment gateway testing?

Payment gateway testing is challenging due to several factors. First, it requires thorough testing of various transaction types, such as credit card payments, refunds, and chargebacks. Ensuring data security and privacy during these transactions is crucial. Additionally, payment gateways need to handle high volumes of transactions smoothly, which can be difficult to simulate and test. Finally, payment gateways must comply with multiple regulations and standards, adding another layer of complexity to the testing process.

How can transaction failures be prevented during payment gateway testing?

To prevent transaction failures during payment gateway testing, follow these steps:

1. Test all types of transactions like payments, refunds, and chargebacks.

2. Ensure the payment gateway handles high volumes of transactions without slowdowns.

3. Regularly update security protocols to protect data and prevent breaches.

4. Check for compatibility with different devices and browsers.

5. Verify that the system meets all necessary regulations and standards.

What best practices we need to follow to ensure payment systems are reliable, secure, and user-friendly?

When testing payment systems, it is essential to:

1. Ensure all payment transactions are encrypted to protect sensitive information.

2. Test the system under different network conditions to check its reliability.

3. Perform thorough security checks to identify and fix vulnerabilities.

4. Validate that the user interface is intuitive and simple for a smooth user experience.

5. Conduct regular updates and maintenance to keep the system secure and efficient.

How to handle unsuccessful transactions or payment disputes?

Handling unsuccessful transactions or payment disputes involves a few simple steps. Firstly, promptly communicate with the customer to inform them of the issue. Then, verify the transaction details and check for any errors. If necessary, coordinate with the payment gateway or bank to resolve the problem. Finally, keep the customer updated throughout the process and offer refunds or alternative solutions if needed.

Conclusion

In conclusion, thorough payment gateway testing is crucial for maintaining a secure, efficient, and reliable e-commerce ecosystem. By implementing these 10 essential payment gateway test cases, businesses can significantly enhance their payment processing systems and minimize potential risks.

Comprehensive payment gateway testing not only ensures smooth transactions but also builds customer trust and protects your brand reputation. As payment technologies continue to evolve, regularly updating and expanding your payment gateway test cases will be key to staying ahead of emerging challenges and opportunities.

Remember, a robust payment gateway testing strategy is not just a one-time effort but an ongoing process that safeguards your business and customers in the ever-changing digital payment landscape.

Related Posts – Test Cases

Related posts:

- eCommerce Testing Guide: How To Test An E-commerce Website

- Product Testing Guide | What You Should Know

- Best Appointment Scheduling Software (Free and Paid)

- AI and IoT are the practical enablers of Digital Transformation

- Database Testing Tutorial – Complete Beginners Guide