Financial Close Process: A Comprehensive Guide for Businesses

Every business needs to know exactly how much money it makes and spends. This is where the financial close process comes in – it’s the organized way companies gather, check, and report all their financial information at the end of accounting cycle. Think of it as taking a complete financial snapshot of your business at a specific time. While keeping track of all transactions and creating financial reports can be challenging, having a well-organized financial close process is crucial. It not only helps businesses maintain accurate records but also enables leaders to make better decisions about their company’s future. This guide will explain what the financial close process is and why it’s so important for every business.

Must read: What is Financial Reconciliation

What Is the Financial Close Process?

Financial Close is a regular process that organizations undergo to finalize their financial statements at the end of an accounting cycle, typically monthly, quarterly, or annually. This process involves gathering, reviewing, and reconciling all financial data to ensure accuracy and completeness. Key activities include verifying transactions, adjusting journal entries, reconciling accounts, and preparing financial statements such as the balance sheet, income statement, and cash flow statement. The financial close process is crucial for providing stakeholders with a clear and accurate picture of the company’s financial health, enabling informed decision-making. Efficient financial close processes can enhance operational efficiency and ensure compliance with financial regulations and reporting standards.

What Is the difference between Financial Closing and Closing the books?

| Aspect | Financial Close | Closing the Books |

|---|---|---|

| Definition | Encompasses the entire process of finalizing financial reports. | Focuses specifically on closing out accounting records. |

| Involvement | Involves analysis, reconciliation, and reporting | Involves basic accounting tasks like recording payments and receipts |

| Scope | Broader, considering all aspects of financial reporting. | Narrower, dealing mainly with accounting entries and reconciliations. |

| Example | Not just recording transactions, but analyzing trends, preparing reports for stakeholders, and ensuring compliance | Recording all sales, expenses, and bank transactions |

Steps to Financial Close

- Gather Financial Information: Collect all relevant financial data and documents such as balance sheets, income statements, and cash flow records.

- Reconcile Accounts: Ensure all bank, credit cards, and other accounts match the records by comparing them against your financial documents to address any discrepancies.

- Adjust Journal Entries: Make any necessary adjustments to reflect accurate financial standings for expenses such as depreciation or accrued liabilities.

- Review and Verify Transactions: Go through all transactions for the period to confirm their accuracy and legitimacy. This is crucial for detecting any errors or fraudulent activity.

- Prepare Financial Statements: Utilize the verified and adjusted data to compile the final financial statements, including the income statement, balance sheet, and cash flow statement.

- Conduct Internal Review: Have internal stakeholders review the financial statements to ensure accuracy and compliance with regulatory standards.

- Finalize Reports: Make corrections if needed and then finalize the financial reports for presentation to external parties like investors or regulatory authorities.

Completing these steps ensures a smooth financial close and provides a clear, accurate picture of an organization’s financial health.

Challenges of Financial Close

- Data Management: Ensuring data accuracy and consistency across various systems and platforms.

- Regulatory Compliance: Adhering to evolving regulatory requirements can add complexity to the process.

- Time Constraints: Meeting tight deadlines pressures finance teams to complete tasks efficiently.

- Volume of Data: Managing large volumes of data can overwhelm finance departments, increasing the risk of errors.

- Interdepartmental Collaboration: Coordinating across departments can lead to communication challenges and misalignment.

- Error Resolution: Identifying and correcting errors or discrepancies without affecting deadlines or accuracy.

- Resource Allocation: Ensuring that appropriate resources are available to manage the workload effectively.

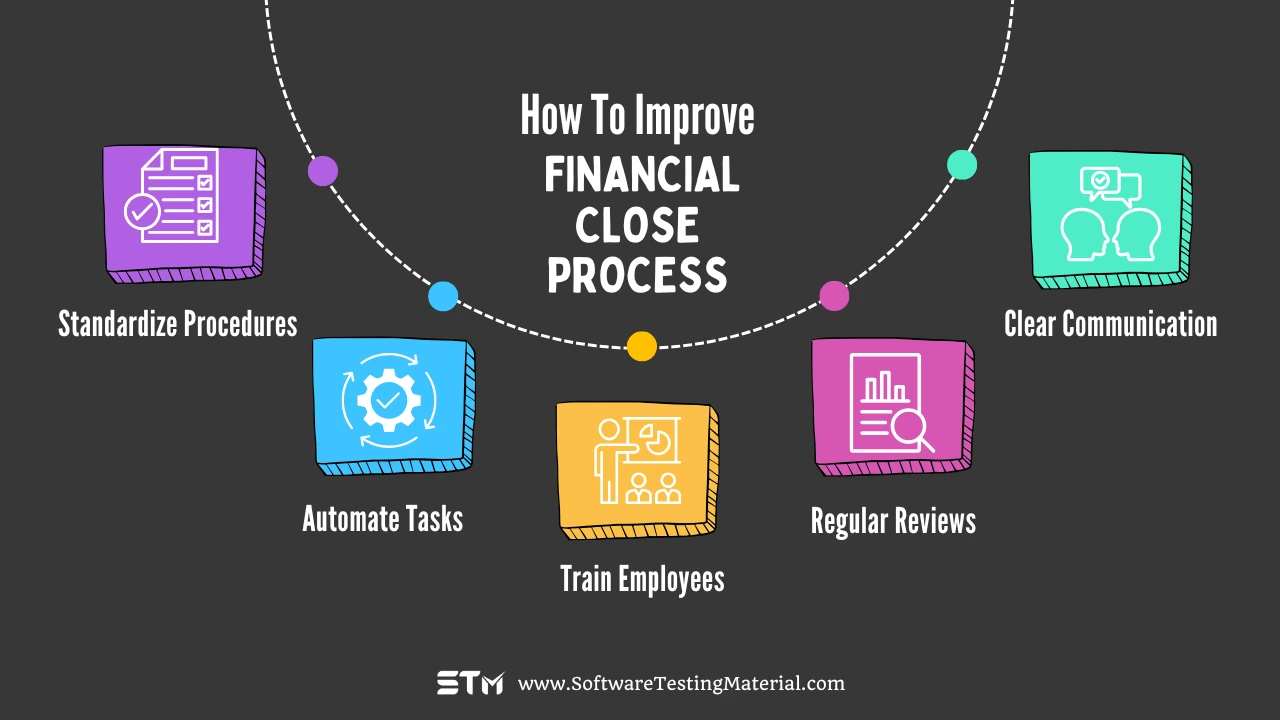

How to Improve the Financial Close Process?

Improving the financial close process can save time and reduce stress for many organizations. Here are some simple steps to make it better:

- Standardize Procedures: Create clear guidelines and templates for financial reports. This helps everyone know exactly what to do and reduces errors.

- Automate Tasks: Use software to automate repetitive tasks like data entry and reconciliation. This cuts down on manual work and speeds up the process.

- Train Employees: Ensure all team members are well-trained in the latest financial tools and practices. This boosts efficiency and ensures everyone is on the same page.

- Regular Reviews: Conduct regular reviews of your closing process to identify bottlenecks and areas for improvement. This helps in making continuous improvements.

- Clear Communication: Ensure open lines of communication between departments involved in the financial close. This prevents misunderstandings and keeps the process smooth.

By implementing these steps, organizations can streamline their financial close process, making it more efficient and accurate.

FAQs

What Are the Goals of Financial Close?

The goals of financial close are to ensure that all financial transactions for a period are complete and accurate. It aims to provide a clear financial picture of a company, helping in decision-making and planning. Financial close also helps identify any errors or discrepancies, ensuring compliance and transparency.

What is month-end close?

Month-end close is the process of finalizing all financial transactions at the end of each month. It involves reviewing and reconciling accounts to ensure they are accurate. This helps a company understand its financial status and prepares financial statements that reflect the company’s monthly performance.

How long should it take to close the books?

Closing the books should ideally take a few days to a week. This allows enough time for accountants to review and confirm all financial transactions are correct. The quicker the process, the sooner companies can have accurate financial statements, helping them make timely decisions.

What does Wd5 mean?

Wd5 stands for “Workday 5,” which generally refers to the fifth business day of the month. This term is often used in financial contexts, such as accounting and reporting, to set deadlines for completing certain tasks. On Wd5, many companies aim to finish the month-end close process, ensuring all financial records are updated and reports can be generated.

Month-End vs. Year-End Close: How They Work?

Month-end close happens at the end of each month, while year-end close is done at the end of the financial year. Month-end close focuses on short-term financial reporting and ensures that monthly transactions are accurately recorded. On the other hand, year-end close is more comprehensive, involving additional tasks like preparing annual financial statements, adjusting entries, and conducting audits if needed. Both processes are essential for maintaining accurate financial records but differ in scope and detail.

Conclusion

In conclusion, a streamlined financial close process is crucial for ensuring the accuracy and reliability of a company’s financial statements. By implementing efficient procedures and utilizing advanced technology, businesses can minimize errors and reduce the time required to finalize their accounts. This not only enhances compliance with regulatory standards but also allows for more strategic decision-making based on up-to-date financial data. Ultimately, refining the financial close process contributes to a more robust and transparent financial management system, crucial for long-term success.

Related posts:

- Best Account Reconciliation Software

- Best Record to Report Automation Software

- Best OneStream Alternatives & Competitors

- Best Blackline Alternatives & Competitors

- Best FloQast Alternatives & Competitors

- Best Trintech Alternatives & Competitors

- What is Financial Reconciliation

- What is Account Reconciliation

- What is a Record to Report (R2R)